Aalst-Erembodegem, November 26, 2014 – Ontex Group NV (Euronext Brussels: ONTEX; ‘Ontex,’ ‘the Group’ or ‘the Company’) and Ontex IV S.A. today announced their unaudited interim results for the three and nine month periods ending September 30, 2014.

Key Ontex Group Highlights Q3 2014

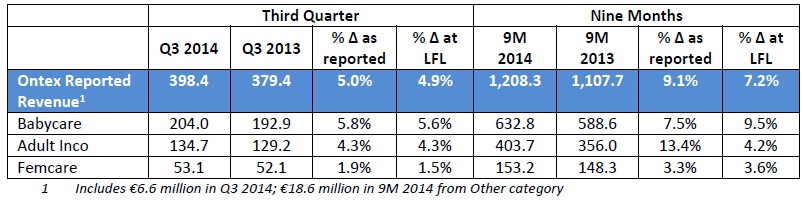

• Revenue at €398.4 million, up 5.0% on a reported basis; revenue up 4.9% on a like-for like (LFL)1 basis against a strong comparable in the prior year

• Further growth of Adjusted EBITDA2, up 8.6% year-on-year to €49.0 million; Adjusted EBITDA margin up 41 bps to 12.3%

• EBITDA generation and a lower working capital drove an increase in Adjusted Free Cash Flow3

• Net Debt4 of €535.0 million and net financial debt/LTM adjusted EBITDA ratio at 2.8x as of September 30, 2014; both decreased versus the respective pro-forma figures at June 30, 2014

Key Ontex Group Highlights 9M 2014

• Revenue at €1,208.3 million, up 9.1% on a reported basis and 7.2% on a LFL basis

• Adjusted EBITDA2 up 15.7% at €147.6 million and Adjusted EBITDA margin of 12.2%, up 70 bps

Key Ontex Group Financials Q3 2014 and 9M 2014

Charles Bouaziz, CEO of Ontex commented: “We continued to show broad-based revenue growth across all divisions and categories to deliver a top line performance in line with expectations, taking into consideration the strong comparable quarter in the prior year. Group top-line growth was in line with our growth model, and we were able to expand Adjusted EBITDA margins further. Finally, we are very pleased to have fundamentally improved our financial position, first by redeeming our €280 million floating rate notes in July, and in November, to have successfully reached agreement to refinance our remaining debt at significantly better terms.”

Charles Bouaziz, CEO of Ontex commented: “We continued to show broad-based revenue growth across all divisions and categories to deliver a top line performance in line with expectations, taking into consideration the strong comparable quarter in the prior year. Group top-line growth was in line with our growth model, and we were able to expand Adjusted EBITDA margins further. Finally, we are very pleased to have fundamentally improved our financial position, first by redeeming our €280 million floating rate notes in July, and in November, to have successfully reached agreement to refinance our remaining debt at significantly better terms.”

1 LFL is defined as at constant currency excluding change in perimeter of consolidation or M&A

2 Adjusted EBITDA for Ontex IV SA at €148.7 million for 9M 2014; €49.7 million for Q3 2014. Adjusted EBITDA is a non-IFRS measure, defined as EBITDA plus non-recurring expenses and revenues excluding non-recurring depreciation and amortization and has consistently been applied throughout reporting periods. EBITDA is a non-IFRS measure, defined as earnings before net finance cost, income taxes, depreciation and amortization

3 Adjusted Free Cash Flow calculated as Adjusted EBITDA less capex, change in working capital and cash taxes paid. Adjusted FCF calculation changed from prior year quarterly disclosure to align with cash flow statement. For reconciliation with previous reporting, refer to Page 17 from the earnings report. Adjusted FCF for Ontex IV SA at €90.2 million for 9M 2014; €46.6 million for Q3 2014

4 Net Debt for Ontex IV SA at €539.8 million as of September 30, 2014 and the difference with Ontex Group NV (€4.8 million) is mainly explained by a difference in cash position.

5 Adjusted Basic Earnings per share (Adjusted EPS) excludes non-recurring expenses of €22.3 million for 9M 2014; €0.3 million for Q3 2014. For definition and further detail refer to Page 11.

Market Dynamics

In the three resilient categories in which the Group is active, the overall market environment, while remaining highly competitive, was broadly stable compared to the prior two quarters in 2014. With the impact of the withdrawal of Kimberly Clark from the Western European baby diaper market completed, growth in mature markets returned to normalised levels, as retailers have successfully transitioned shelf space from A brands to their retailer branded products.

In Q3, the Group saw a more moderate overall impact from currency fluctuations compared to the prior two quarters of 2014. Whilst the depreciation of the Turkish Lira and Russian Rouble versus the euro negatively affected the Group’s results, especially within the MEA and Growth Market divisions, the continued appreciation of the British Pound during the quarter mitigated these effects.

As expected, raw material prices rose slightly over the third quarter versus the previous quarter, and the Group continued to implement several initiatives that have been successful in mitigating the impact from these increases, such as efficiency programmes as well as price adjustments where relevant.

Overview of Ontex Performance in Q3 2014

Trading for Q3 2014 was in line with Ontex’s growth model, with the Group posting overall reported sales of €398.4 million, an increase of 5.0% year-on-year, and 4.9% on a LFL basis. From a nine months perspective, Ontex recorded 9.1% growth in 2014 compared to the same period last year, and 7.2% on a LFL basis.

Third quarter growth was broad-based, with all divisions, categories and geographies contributing to the performance. In Mature Market Retail, LFL revenue continued to grow as a result of retailer brands performance, and Healthcare revenue increased on a LFL basis in line with management estimated market growth. Growth Markets delivered a strong LFL revenue increase, and in the MEA division, for which Q3 is traditionally a slower quarter, revenue continued to rise on a LFL basis, albeit at a slower rate than the first two quarters.

Adjusted EBITDA in Q3 2014 was up by 8.6% to €49.0 million, and 15.7% year-on-year for 9M 2014. As a result, Q3 2014 adjusted EBITDA margin was 12.3%, up by 41 bps compared to the same quarter last year. The adjusted EBITDA increase is attributable to a higher gross margin on the back of top line growth and ongoing productivity improvement.

REVENUE

Operational Review: Divisions

Mature Market Retail

Mature Market Retail demonstrated robust performance, with Q3 2014 sales rising 4.7% year-on-year on a LFL basis. With the impact of the withdrawal of Kimberly Clark from the Western European baby diaper market now complete, which led to strong revenue growth in H1, market dynamics normalised in the third quarter. In particular, revenue in the UK edged slightly lower following strong retailer brand gains since mid-2013 due to the KC exit. However, this was more than offset by solid growth in other countries through continued collaboration with retailers to promote their own brands.

Growth Markets

Our Growth Markets division continued to post strong double digit growth, with Q3 2014 revenue up 19.0% on a LFL basis. This performance continued to be led by Russia, which represents the largest share of the division, despite macro volatility in the region. Significant demand from national accounts for retailer brands continued, which aligns well with the strengths Ontex offers its partners. Reported revenue rose by 10.4%; this variance compared to LFL revenue growth was largely due to the negative impact of the depreciation of the Russian Rouble.

MEA

Revenue in the MEA division moderated during the traditionally slower third quarter, with LFL sales up 6.6% in Q3 2014. Divisional growth was helped by further revenue increases in Turkey, while Morocco and Pakistan continued to present encouraging performances, benefitting from successful market penetration. Several other countries in the MEA region experienced challenging political and economic environments, leading to a lower revenue on a year-on-year basis. Reported revenue continued to be impacted by the overall unfavourable FX conditions albeit to a lesser extent than the prior two quarters.

Healthcare

Following a solid performance in Q2, Healthcare division revenue was up 1.6% on a LFL basis for Q3 2014, in line with estimated market growth. The division benefited from good performances in the home delivery channels in both the UK and Italy, while revenue in Germany was lower due to scaling back of certain customer contracts. Serenity continued to perform well and in line with our expectations.

Operational Review: Categories

Babycare

Revenue for Babycare in Q3 2014 rose 5.6% LFL. This growth, on the back of an increase of 14.6% LFL in Q3 2013, reinforces our strategy of partnering with retailers to position their own brands as a smart choice alternative to A brands. Ontex continued to ensure that innovation is a key differentiating feature of its offering, as demonstrated by the further roll out of Supercore II to more customers during the third quarter.

Adult Inco

Adult inco sales were encouraging in Q3 2014 with revenue up 4.3% on a LFL basis, with further growth in both the retail and institutional channels. In particular, performance was strong in Adult Inco in Mature Market Retail, where sales were up 14% in the quarter.

Femcare

Sales of Femcare products rose 1.5% on a LFL basis in Q3 2014 following higher growth in the prior two quarters, and following more than 11% growth in Q3 2013. Looking ahead, innovation is anticipated to support further growth in the coming quarters.

Operational Review: Geographies

With solid growth in Eastern Europe and ROW, revenue for these two regions represented 31% of total Ontex sales in Q3 2014, in-line with the previous quarter and slightly more than a year ago. Western Europe had a lower LFL increase as the strong gains in retailer brands following the exit of Kimberly Clark have been previously realised, whilst the majority of the Healthcare division’s sales, where the top line grows at a relatively lower level than retail, are in Western Europe.

STRATEGIC PROGRESS & PRIORITIES

Capitalising on the strong momentum since the IPO in June, we obtained agreement on significantly better terms for our remaining debt, following the refinancing negotiated in November 2014 which is scheduled to close in early December. This important step, and the related two notch improvements in the Group’s credit ratings as disclosed by two major rating agencies (Moody’s Ba3; S&P BB-), confirm the strategic progress Ontex has made and will deliver an immediate boost to cash flows.

Following these key events, we will continue to focus on operational excellence in order to better serve our customers, increase consumer satisfaction and deliver sustainable, profitable growth.

Management anticipates a slight increase in overall raw material prices for Q4 as the decrease in oil prices have not impacted the costs of oil-based raw materials yet, which typically lag the oil price changes by about three months. The most recent oil-related indices are slightly lower following the oil price decreases, and if this trend were to continue, this is expected to moderately impact our Q1 raw material prices favourably. In view of the current stabilisation of fluff prices, we expect Q4 prices to remain broadly flat compared to Q3.

FINANCIAL REVIEW

Gross Margin

Gross margin was €111.3 million in Q3 2014, representing an increase of 9.3% year-on-year. The gross margin as a percentage of sales increased by 111 bps year-on-year to 27.9% of sales partly due to operating leverage and ongoing cost improvement projects.

Adjusted EBITDA

Adjusted EBITDA grew by 8.6% year-on-year in Q3 2014, ahead of revenue growth, to €49.0 million. In addition to the increased gross margin, the main operating expenses grew largely in-line with sales to remain relatively stable as a percentage of revenue.

Foreign Exchange

The impact of foreign exchange fluctuations against the euro was fairly limited on revenue as well as EBITDA. FX losses, mainly related to the Turkish Lira and Russian Rouble, were compensated by gains from the British Pound. The Group maintains a vigilant approach to ensure that foreign exchange volatility is limited in the short term through the use of hedging agreements.

Non-recurring revenue and expenses

Non-recurring revenue and expenses were negligible for Q3 2014, while for 9M 2014 the expenses mostly stem from IPO related costs which have been fully recognized in H1 2014. Details can be found in Note 9 of the Unaudited Condensed Consolidated Interim Financial Statements for the quarters ended September 30, 2014 and September 30, 2013.

Working Capital

Cash generation from working capital for the third quarter of 2014 amounted to €15.3 million. This was partly due to a positive impact from payment cycle timing, which was only partially offset by a build-up of inventory. In addition, prior outflows due to VAT receivables in Italy were curtailed during Q3. The Group expects to remain within its guidance of net working capital amounting to no more than 12% of sales at the end of December 2014.

Cash Taxes

Cash taxes paid amounted to €5.9 million in Q3 2014, and €10.0 million for 9M 2014. Cash taxes in Q3 2014 were higher than the prior two quarters due to the timing of Italian prepayments shifting into Q3 as previously disclosed.

Capex

Capex spend of €10.4 million in Q3 2014 was higher than in Q3 2013 due to phasing of planned 2014 expenditures being more weighted in the second half.

The Group reconfirms its expectation that capital expenditures should amount to approximately 3% of sales for the full year 2014.

Adjusted Free Cash Flow (post tax)

Adjusted Free Cash Flow generation for the three month period amounted to €48.0 million, a 34.5% increase from the previous year. This increase is mainly attributable to higher Adjusted EBITDA contribution and lower working capital as discussed above.

Financing and Liquidity

Cash and Cash equivalents totalled €111.0 million on September 30, 2014.

Net debt of €535.0 million at September 30, 2014 was lower than pro forma net debt of € 565.9 million at June 30, 2014, and based on the last twelve months Adjusted EBITDA, resulted in net leverage of 2.8x.

The revolving credit facility of €75.0 million remained undrawn at the end of the period and consequently, available liquidity was €186.0 million as of September 30, 2014.

CONFERENCE CALL

Management will host a presentation for investors and analysts on November 26, 2014 at 9:00am GMT / 10:00am CET. A copy of the presentation slides will be available at http://www.ontexglobal.com/.

If you would like to participate in the conference call, please dial-in 5-10 minutes prior using the details below:

United Kingdom: +44 (0)20 3427 1907

United States: +1 212 444 0481

Belgium: +32 (0)2 404 0660

Conference ID: 9723979

FINANCIAL REPORT

Ontex’s interim financial report, which includes its unaudited financial statements, is available on its website at http://www.ontexglobal.com/financial-reports.

CORPORATE GOVERNANCE

Please refer to the relevant Management and Corporate Governance sections on pages 113 through 126 of the Prospectus dated June 10, 2014. This Prospectus can be found on the corporate website of Ontex Group NV: http://www.ontexglobal.com/.

After publication of the prospectus, the changes below have taken place.

As of 1 September 2014, Alexandre Mignotte was appointed as non-executive Board member, and replaces Dominique Le Gal. Alexandre Mignotte is an Executive Director in the Merchant Banking Division (MBD) of Goldman Sachs in London, where he is responsible for sourcing, executing and managing corporate debt investments in France and Benelux. He joined the Merchant Banking Division of Goldman Sachs in May 2006, and was named Executive Director in 2012. Mr Mignotte represents GS Mezzanine Partners on the boards of Holdelis S.A.S. (Elis) and Financière Médisquare S.A.S. (Médi-Partenaires – Médipôle Sud Santé) as an observer. He graduated from ESSEC Business School in 2006.

As of 1 October 2014, Astrid De Lathauwer has joined the Executive Management Team as Group Human Resources Director. Mrs. De Lathauwer held international HR leadership roles at AT&T in Europe and at their U.S. headquarters, and at Monsanto. For 10 years Mrs. De Lathauwer was the Chief HR officer of Belgacom. Before joining Ontex, she was Managing Director of Acerta Consult. Mrs. De Lathauwer holds degrees in Political & Social Science and History of Art.

MATERIAL RISK FACTORS

There have been no material changes to the business risk factors disclosed in the Prospectus dated June 10, 2014 on pages 26 through 38.

FINANCIAL CALENDAR 2015

Q4 & FY 2014 March 5, 2015

Q1 2015 May 11, 2015

Q2 & HY 2015 July 29, 2015

Q3 & 9M 2015 November 5, 2015

ENQUIRIES

Investors

Philip Ludwig

+32 53 333 730

[email protected]

Fairvue Partners

+44 20 7614 2900

[email protected]

DISCLAIMER

This report may include forward-looking statements. Forward-looking statements are statements regarding or based upon our management’s current intentions, beliefs or expectations relating to, among other things, Ontex’s future results of operations, financial condition, liquidity, prospects, growth, strategies or developments in the industry in which we operate. By their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results or future events to differ materially from those expressed or implied thereby. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein.

Please read the full financial report in the attached pdf file.