Disclosure made according to the requirements of Article 14 of the law of 2 May 2007

Aalst-Erembodegem (Belgium), 20 July 2018 – Ontex Group NV (“Ontex”) discloses the notifications of significant shareholdings that it has received according to the Belgian Law of 2 May 2007 on the disclosure of significant shareholdings in listed companies.

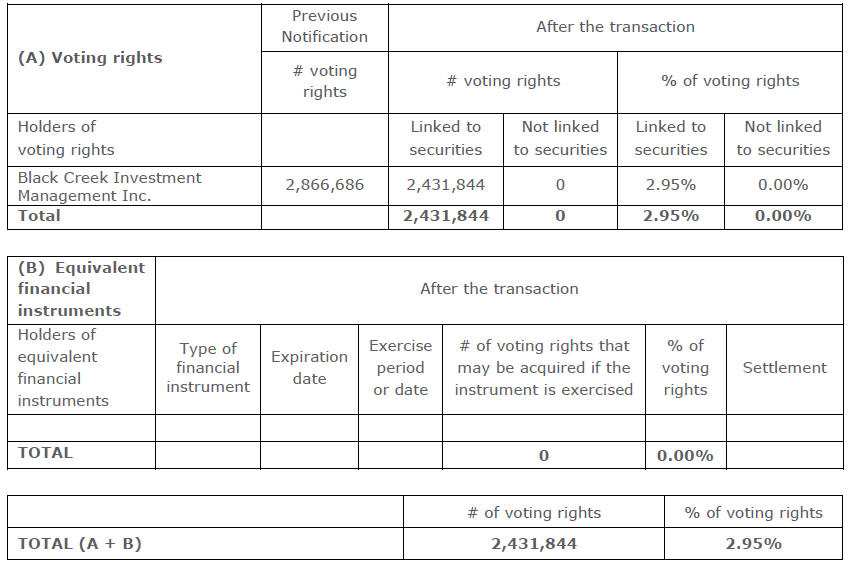

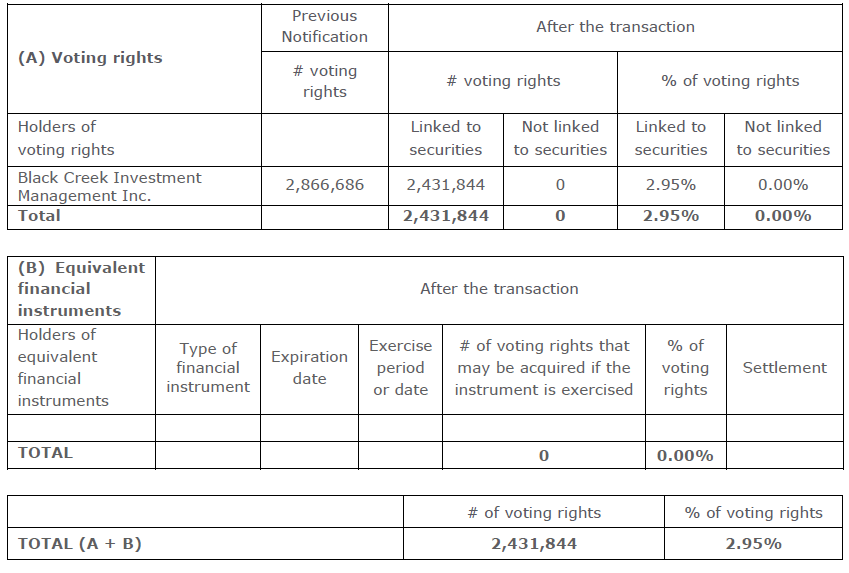

On 18 July 2018, Black Creek Investment Management Inc. notified Ontex that it had, as a result of sale of shares, crossed below the threshold of 3.00% of the total number of voting rights in Ontex.

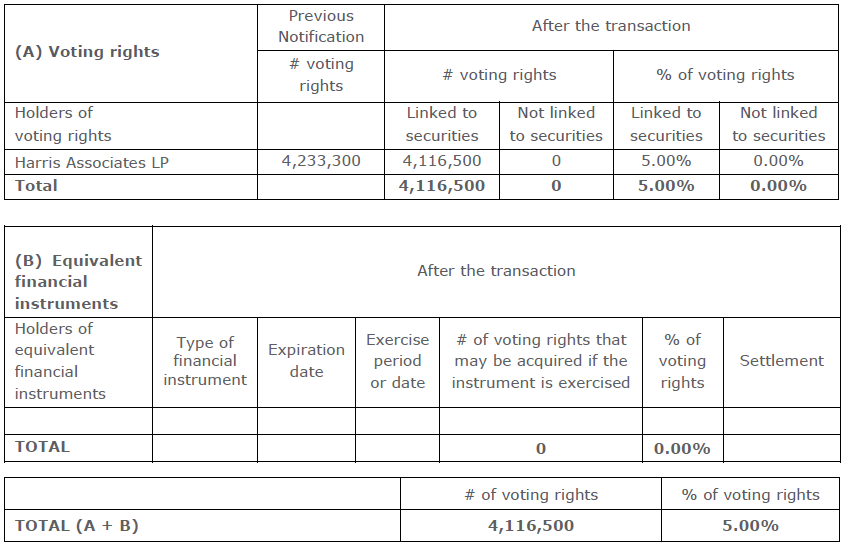

On 19 July 2018, Harris Associates LP notified Ontex that it had, as a result of sales of shares, crossed below the threshold of 5.00% of the total number of voting rights in Ontex.

According to its obligation Ontex publishes the content of the notifications that it has received.

Date of Notifications: 18 and 19 July 2018

Date Threshold Crossed: 16 and 11 July 2018

Thresholds Crossed: 3.00% and 5.00%

Notifications by:

Denominator on the date of notification: 82,347,218 shares

Voting rights and assimilated financial instruments:

Notification from Black Creek Investment Management Inc

Chain of controlled entities through which the shareholding is effectively owned:

Black Creek Investment Management Inc. is not a controlled entity.

Additional information

Black Creek Investment Management Inc. acts as discretionary investment manager and holds voting rights attached to shares on behalf of its clients. The disclosure obligation arose due to Black Creek Investment Management Inc.’s voting rights crossing below 3%. Black Creek Investment Management Inc. can exercise the voting rights in its discretion, without any instruction from its clients.

Notification from Harris Associates LP

Chain of controlled entities through which the shareholding is effectively owned:

Harris Associates L.P. (“”Harris””) is an indirect wholly-owned subsidiary of Natixis Investment Managers, L.P., which is an indirect subsidiary of Natixis Investment Managers, an international asset management group based in Paris, France. Natixis Investment Managers is owned by Natixis, a French investment banking and financial services firm. Natixis is principally owned by BPCE, France’s second largest banking group. BPCE is owned by banks comprising two autonomous and complementary retail banking networks consisting of the Caisse d’Epargne regional savings banks and the Banque Populaire regional cooperative banks.

Harris is an SEC registered investment adviser organized in the United States, which makes investments, including the Belgian holding at issue, on behalf of clients. Harris does not make investments in Belgian securities for its own account. Harris exercises voting rights for clients independently from its direct and indirect parent companies, including Natixis Investment Managers and its other subsidiaries.

Additional information

Harris Associates LP is the appointed investment manager to several accounts, which in aggregate hold the voting rights disclosed above. Harris Associates LP can exercise the voting rights at its discretion in the absence of specific instructions from the relevant undertaking of collective investments. This notification is to inform you of the downward crossing of the 5% transparency threshold as of 11 July 2018, to 4.9990%.

Notifications of significant shareholdings to be made according to the Law of 2 May 2007 should be sent to: [email protected]

This notification will be posted on: http://www.ontexglobal.com/press-room

Contact