Aalst-Erembodegem, August 29, 2014 – Ontex Group NV (Euronext Brussels: ONTEX; ‘Ontex,’ ‘the Group’ or ‘the Company’) and Ontex IV S.A. today announced their unaudited interim results for the three and six month periods ending June 30, 2014.

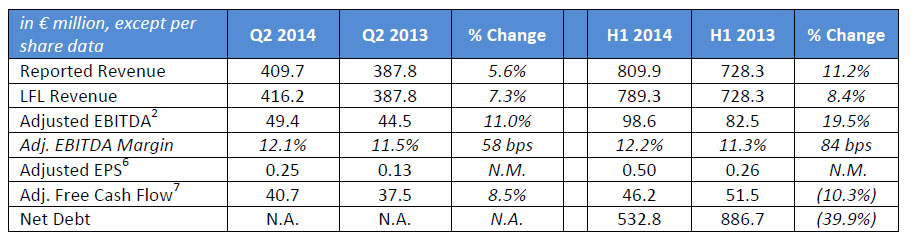

Key Ontex Group Highlights H1 2014

• Revenue at €809.9 million, up 11.2% on a reported basis; revenue up 8.4% on a like-for like (LFL)1 basis

• Continued improvement in Adjusted EBITDA2, up 19.5% year-on-year to €98.6 million

• Adjusted EBITDA margin up 84 bps to 12.2%

• Working capital consumption drives decrease in Adjusted Free Cash Flow3, although partially offset by lower tax payments and capital expenditures due to phasing

• Net Debt4 reduced to €532.8 million and pro forma5 net financial debt/LTM adjusted EBITDA ratio at 3.0x as of June 30, 2014 resulting in further strengthening of the financial structure post IPO

Key Ontex Group Highlights Q2 2014

• Revenue at €416.2 million, up 5.6% on a reported basis and 7.3% on a LFL basis, in line with expectations at the time of the IPO

• Adjusted EBITDA2 up 11.0% at €49.4 million and Adjusted EBITDA margin at 12.1%, up 58 bps

Key Ontex Group Financials H1 2014 and Q2 2014

Charles Bouaziz, CEO of Ontex commented: ‘Our performance in the second quarter of 2014 was a continuation of the trends seen in 2013 and in the first three month of the year, with a robust performance across all our key product groups. In our mature markets, we have continued to support retailers in the development of their brands, whilst favourable demographics and the development of our Ontex brands has delivered very strong top line growth in our MEA and Growth markets divisions. With our continued focus on sustainable growth, we have leveraged this performance to deliver improvements in profitability, whilst adding additional capacity during the first half to support future growth.

Charles Bouaziz, CEO of Ontex commented: ‘Our performance in the second quarter of 2014 was a continuation of the trends seen in 2013 and in the first three month of the year, with a robust performance across all our key product groups. In our mature markets, we have continued to support retailers in the development of their brands, whilst favourable demographics and the development of our Ontex brands has delivered very strong top line growth in our MEA and Growth markets divisions. With our continued focus on sustainable growth, we have leveraged this performance to deliver improvements in profitability, whilst adding additional capacity during the first half to support future growth.

1 LFL is defined as at constant currency excluding change in perimeter of consolidation or M&A

2 Adjusted EBITDA for Ontex IV SA at €99.0 million for H1 2014; €49.6 million for Q2 2014. Adjusted EBITDA is a non-IFRS measure, defined as EBITDA plus non-recurring expenses excluding non-recurring depreciation and amortization and has consistently been applied throughout reporting periods. EBITDA is a non-IFRS measure, defined as earnings before net finance cost, income taxes, depreciation and amortization

3 Adjusted Free Cash Flow calculated as Adjusted EBITDA less capex, change in working capital and cash taxes paid. Adjusted FCF calculation changed from previous quarterly disclosure to align with cash flow statement. For reconciliation with previous reporting, refer to Page 18 in the earnings report.

4 Net Debt for Ontex IV SA at €847.5 million as of June 30, 2014 and the difference with Ontex Group NV (€532.8 million) is mainly explained by the net proceeds from the IPO primary issue.

5 Pro-forma net debt adjusted for IPO costs to be paid from proceeds of the IPO

6 Adjusted Basic Earnings per share (Adjusted EPS) excludes non-recurring expenses of €22.0 million for H1 2014; €19.7 million for Q2 2014. For definition and further detail refer to Page 10-11 in the earnings report.

7 Adjusted FCF post tax calculated as adjusted EBITDA less capex, change in working capital and cash taxes paid. Adjusted FCF for Ontex IV SA at €43.6 million for H1 2014; €38.1 million for Q2 2014

Market Dynamics

The general macro environment observed in the first quarter of 2014 has broadly remained unchanged in the second quarter of 2014, with a variable impact in the different geographies.

Within our mature markets, our clients have continued to leverage the withdrawal of Kimberly-Clark (K-C) from the Western European baby diaper market, as they look to further expand their retailer brands. As such, their focus has been on driving sales, improving positioning through quality and innovation, and increasing marketing efforts that will yield positive results going forward.

While we still had strong headwinds from foreign exchange in Q1, the impact in Q2 versus the prior year was moderate. In particular, the appreciation during the second quarter, of the British Pound, Australian Dollar and Turkish Lira has helped limiting the adverse impact from currency movements on our results. This was slightly offset by the appreciation of the U.S. Dollar in which we make significant raw material purchases.

The raw material price fluctuations were moderate and in line with expectations. Additionally, the anticipated rise in the prices of raw materials for FY 2014 has been partly mitigated by sales price increases, commodity hedging arrangements and supplier contract negotiations and savings programs.

Overview of Ontex Performance in H1 2014

The Group demonstrated a solid performance across the board in all product groups and divisions, and delivered continued growth. Group sales of €809.9 million represents an increase of 11.2% compared to H1 2013 on a reported basis, and 8.4% on a LFL basis. In Western Europe, the Group continued to see an increased share of retailer brands in this region and the healthcare division performed in line with expectations. Furthermore, the Growth Markets and MEA divisions also registered double digit growth on a LFL basis, in H1 2014, on the back of continuing favourable growth drivers such as demographic trends, increasing product adoption rates, and a good performance of our brands.

Adjusted EBITDA grew 19.5% to €98.6 million, due to the strong growth of the business, consolidation of Serenity, combined with operating leverage and efficiency gains. The adverse impact from currency movements and the moderate increases in raw material prices were more than offset by the results of our continuous improvement programs.

REVENUE

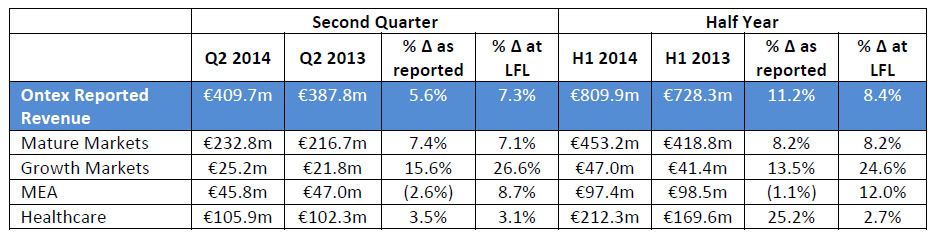

Operational Review: Divisions

Mature Market Retail

Sales in Mature market retail grew strongly, up 8.2% year-on-year in H1 2014 as the Group continued to support retailers grow their share of market. The momentum generated from the K-C withdrawal in the Western European baby diaper market continued to contribute to the division’s performance, particularly in the UK, as retailers looked to build their brands and capture volumes. However, benefits from the K-C withdrawal are now largely complete. The division experienced also strong performance in Poland with key customers.

Growth Markets

Growth markets saw stellar performance in H1 2014, albeit on a small base, increasing sales by 24.6% on a LFL basis through continued penetration in Central Europe. Russia demonstrated strong growth across all categories despite political instability, helped by the local manufacturing facility. However, the depreciation of the Russian Rouble impacted results with the division up 13.5% on a reported basis.

MEA

The MEA division continued to deliver positive results with LFL revenues up 12.0% in H1 2014. Reported sales were lower by 1.1% over the same period in 2013 on the back of currency headwinds in the region. The Company has strengthened its position in one of its key markets, Turkey, by rising to second position in another key region in the country. Furthermore, the Company also witnessed strong performance in Morocco and Pakistan.

Healthcare

LFL Sales in Healthcare were up 2.7% year-on-year, performing slightly ahead of the market growth in H1 2014. The UK and Ireland demonstrated good progress over the period which can be attributed primarily due to the home delivery segment. Additionally, the division saw good traction in two of its core markets: France, through contracts gains, and Italy, through renewals of public tender contracts. The Serenity business, which was fully consolidated from Q2 2013 onwards, continues to perform in line with management expectations.

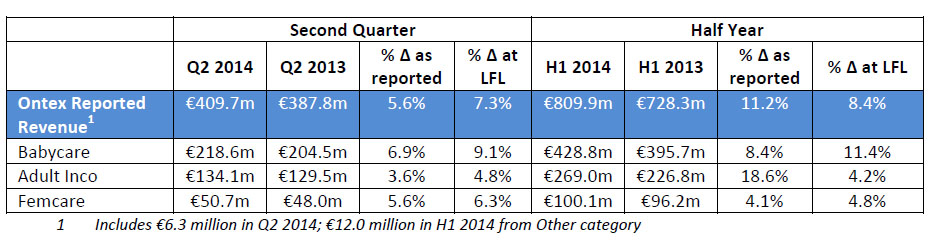

Operational Review: Categories

Babycare

Ontex benefitted from an increased penetration of retailer brands in the Western European baby diaper market, as some retailers, in conjunction with Ontex, continued to proactively promote their own brands as a direct alternative to the A-brands. As a result, the Company’s flexible approach to retailer branding has been further strengthened. Ontex is focussed on further reinforcing its position in the category through the roll-out of its latest innovation of a thinner diaper, “Supercore II”, in Western Europe.

Adult Inco

Sales of incontinence products increased 4.2% year-on-year on a LFL basis with robust sales growth in the institutional as well as retail channels. The growth can be attributed primarily to a strong performance in Russia and Turkey, growth of existing business as well as new contracts in the Western European retailer market as well as the positive developments in the institutional market.

Femcare

Femcare was up 4.8% year-on-year on a LFL basis thanks to contract wins phasing in in Western Europe and robust growth in the Growth Markets division.

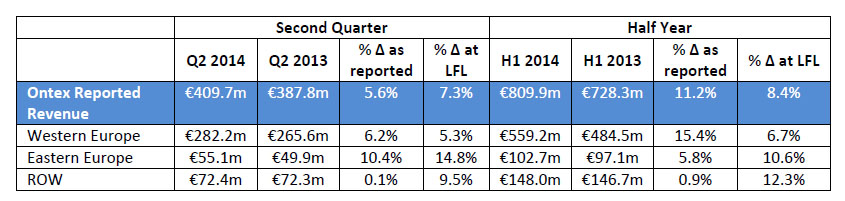

Operational Review: Geographies

Ontex’s geographical mix remained stable, with Eastern Europe and Rest of the World regions totalling 31.0% of total reported Group sales. Growth remained strong across all geographies on a LFL basis. In MEA, sales generated in Turkey account for less than half of total sales.

STRATEGIC PROGRESS & PRIORITIES

The Company is continuing to progress on the major strategic initiatives outlined earlier in the year, aiming to fully execute on the defined action plan that will secure sustainable profitable growth in the long term. For the remainder of the year, the Company is well positioned to ramp up its production output in the event of continuing favourable market trends and further push from our retailer clients. Furthermore, in order to support the growth of the business, we continue to execute on the planned upscaling of central sales, marketing, R&D and support functions.

We are also focused on capitalising on the recent IPO to continue to optimise our capital structure, and as such have started to assess refinancing options for the remaining debt in order to reduce interest costs. The management team continues to assess the macro environment and expects raw material prices to rise slightly in the third quarter. On a full year basis, we expect the overall impact of raw material price fluctuations to be moderate and partially mitigated by savings programs and the current commodity hedging policies and contract terms in place.

FINANCIAL REVIEW

Gross Margin

Gross margin was €222.3 million in H1 2014, an increase of 16.9% year-on-year. This gross margin represents 27.4% of sales for the period, up 133 bps over the prior year. The increase in gross margin can be partly attributed to the Serenity acquisition. Serenity has higher gross margins to cover the increased distribution and logistical costs related to home delivery. Additionally, the favourable impact from the operating leverage (as a result of the business growth) and continuous improvement programs has more than offset the adverse impact from currency movements and raw material price increases.

Adjusted EBITDA

Adjusted EBITDA increased by 19.5% year-on-year in H1 2014 to €98.6 million, ahead of the revenue and gross margin growth. Some of the factors mentioned above contributed to this increase, including active management of cost saving programs and manufacturing operational leverage as the business grows in scale. Adjusted EBITDA also benefitted from the fact that the marketing activity in H1 2014 was relatively low and from the integration of Serenity.

Foreign Exchange

Although positive developments from the British Pound, the Australian Dollar and the Turkish Lira during the second quarter helped limit the foreign exchange impact on sales and adjusted EBITDA, we report overall a net adverse impact from currency evolutions on the H1 sales and adjusted EBITDA.

Net currency headwinds had a negative impact on Adjusted EBITDA of €5.2 million for H1 2014 (€1.0 million for Q2 2014). The negative impact from mainly the Turkish Lira, Russian Rouble and the Australian Dollar are only partially offset by favourable impact from the British Pound and the U.S. Dollar.

The Group continues to actively monitor currency movements and has implemented hedging strategies to limit volatility on a long-term basis. The volatility on the Turkish Lira, and to a lesser extent on the Russian Rouble are also partially mitigated by local production in those countries.

Non-recurring revenue and expenses

Non-recurring revenue and expenses primarily relate to the costs of the IPO. More details can be found in Note 9 of the Unaudited Condensed Interim Financial Statements for the quarters ended June 30, 2014 and June 30, 2013.

Working Capital

Working capital was mainly impacted by a rise in inventory levels and trade receivables leading to a consumption of €29.6 million in H1 2014. The build-up in inventories can be partially attributed to stockpiling of raw materials in remote countries, such as Algeria and Pakistan, to ensure the Company can meet local demand in light of the unstable political environment. Furthermore, Ontex has returned to adequate levels of stock in baby diapers following the lower levels at the end of last year as a result of the high demand post K-C withdrawal. Receivables also increased in the period, following a shift in customer mix towards customers with longer payment terms and an increase of VAT receivables, particularly in Italy. The increase in working capital has been partially mitigated by additional non-recourse factoring.

Cash Tax

Cash Taxes paid amounted to €4.1 million, compared to €8.0 million in H1 2013, mainly as a result of 2014 tax prepayments in Italy shifting towards H2 2014, compared to H1 in the prior year.

Capex

Capex spend was 30.0% lower than in H1 2013 and totalled €18.7 million in H1 2014, in line with expectations and the planned investments program. For 2014, management continues to expect capex funding needs to remain broadly in line with FY 2013 with levels at approximately 3% of sales.

Adjusted Free Cash Flow (post tax)

Adjusted Free Cash Flow is calculated as Adjusted EBITDA less capex, change in working capital and cash taxes paid. The Adjusted FCF calculation has been changed from previous quarterly disclosures to align with the presentation of the cash flow statement whereby non-recourse factoring is accounted for in net cash generated from operating activities. For a reconciliation with previous reporting, refer to Page 18 of the earnings report.

Adjusted Free Cash Flow generation for the six month period amounted to €46.2 million, a 10.3% decrease from the previous year. The increase in Adjusted EBITDA contribution was offset by the increase in working capital requirements due to higher inventory and receivables balances.

Financing and Liquidity

Cash and Cash equivalents stood at €65.3 million on June 30, 2014 excluding the €313.1 million of net cash proceeds from the IPO. Those net proceeds were used to repay the €280 million floating rate notes and to pay the remaining costs related to the IPO, both subsequent to the period end. The revolving credit facility was undrawn at €75.0 million at the end of the period. As a result, pro forma (adjusted for FRN repayment and IPO costs to be paid) available liquidity totalled €140.3 million as of June 30, 2014.

CONFERENCE CALL AND WEBCAST

Management will host a presentation for investors and analysts on August 29, 2014 at 3:00pm BST / 4:00pm CEST. A copy of the presentation slides and a live webcast of the presentation will be available at http://www.ontexglobal.com/.

FINANCIAL REPORT

Ontex’s interim financial report, which includes its unaudited financial statements, is available on its website at www.ontexglobal.com.

CORPORATE GOVERNANCE

Please refer to the relevant Management and Corporate Governance sections on pages 113 through 126 of the Prospectus dated June 10, 2014. This Prospectus can be found on the corporate website of Ontex Group NV: http://www.ontexglobal.com/.

MATERIAL RISK FACTORS

There have been no material changes to the risk factors disclosed in the Prospectus dated June 10, 2014 on pages 26 through 38.

ENQUIRIES

Investors

Fairvue Partners

Severine Camp and Hannah Jethwani

+44 20 7614 2900

[email protected]

DISCLAIMER

This report may include forward-looking statements. Forward-looking statements are statements regarding or based upon our management’s current intentions, beliefs or expectations relating to, among other things, Ontex’s future results of operations, financial condition, liquidity, prospects, growth, strategies or developments in the industry in which we operate. By their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results or future events to differ materially from those expressed or implied thereby. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein.

Please read the full financial report in the attached pdf file.