Aalst-Erembodegem, March 8, 2016 – Ontex Group NV (Euronext Brussels: ONTEX; ‘Ontex,’ ‘the Group’ or ‘the Company’) today announced their results for the fourth quarter (Q4) and Full Year (FY) ending December 31, 2015.

FY 2015 Highlights

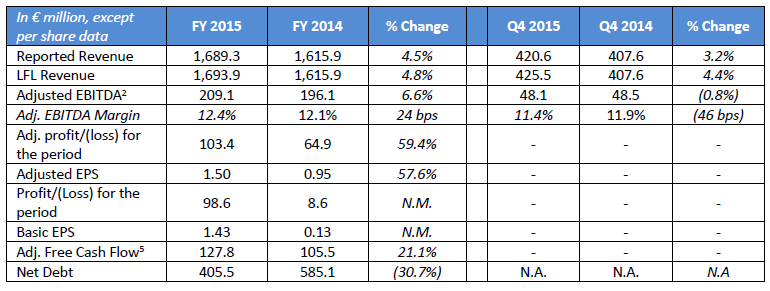

- Revenue of €1.69 billion, up 4.5% on a reported basis and 4.8% on a like-for-like (LFL)1 basis, year-on-year (yoy)

- Adjusted EBITDA2 increased by 6.6% yoy to €209.1 million, resulting in an Adjusted EBITDA margin of 12.4%, in line with our expectations

- Net foreign exchange (FX) impact of negative €4.6 million on revenue, and negative €30.6 million on Adjusted EBITDA

- Adjusted net profit was €103.4 million and Adjusted earnings per share was €1.50, up 57.6% compared to a year ago

- Net Debt was €405.5 million as of December 31, 2015, resulting in a net debt/LTM Adjusted EBITDA ratio of 1.94x. Following the completion of the acquisition of Grupo Mabe, leverage has increased to be above 2.5x

- Acquired Grupo P.I. Mabe S.A. de C.V. (“Grupo Mabe”), a leading Mexican based hygienic disposables business, marking our first steps into the Americas3

- The Board of Directors proposes to pay a gross dividend of 0.46 euro per share4, subject to approval by shareholders at the next general meeting

Q4 2015 Highlights

- Revenue was €420.6 million, a yoy increase of 3.2% on a reported basis and 4.4% on a LFL basis

- Adjusted EBITDA was 0.8% lower yoy at €48.1 million; Adjusted EBITDA margin contracted by 46 basis points to 11.4%

- Net FX impact of negative €4.9 million on revenue, and negative €10.5 million on Adjusted EBITDA

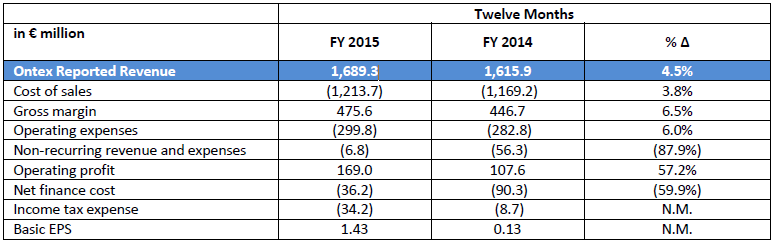

Key Financials FY 2015 and Q4 2015

Charles Bouaziz, Ontex CEO: “We can be proud of our performance in 2015. In highly competitive marketplaces, we delivered another year of solid organic growth in line with our operating model: 4.8% higher revenue, while expanding our Adjusted EBITDA margin to 12.4%, compared to 12.1% in 2014 and 11.6% in 2013. Our 2015 results were achieved despite significant volatility in both foreign exchange rates and several main commodities, which resulted in a material negative impact on reported revenue and Adjusted EBITDA, and was worse than we disclosed at the beginning of the year. Our constant focus on achieving efficiencies day in and day out allowed us to not only mitigate these negative impacts, but to continue strengthening the organization, particularly in sales, marketing and supporting functions. This confirms once again the resilience of the Ontex model.

Next to this solid organic performance, we reached agreement to acquire Grupo Mabe, a leading Mexican based hygienic disposables business, which has now been completed. Grupo Mabe is an excellent fit for Ontex – a family company with a deep understanding of their local consumers, built on strong brands in growing markets. Our first acquisition since our IPO will accelerate the transformation of Ontex on our journey to become a leading consumer goods company.”

1 LFL is defined as at constant currency excluding change in perimeter of consolidation or M&A

2 Adjusted EBITDA is a non-IFRS measure, defined as EBITDA plus non-recurring expenses (including the IPO and refinancing for 2014) and revenues excluding non-recurring depreciation and amortization and has consistently been applied throughout reporting periods. EBITDA is a non-IFRS measure, defined as earnings before net finance cost, income taxes, depreciation and amortization. For further detail refer to Annex A, page 18.

3 See press release dated March 1, 2016

4 Dividend per share calculated on the basis of 74,861,108 shares outstanding, valid on the date of this press release

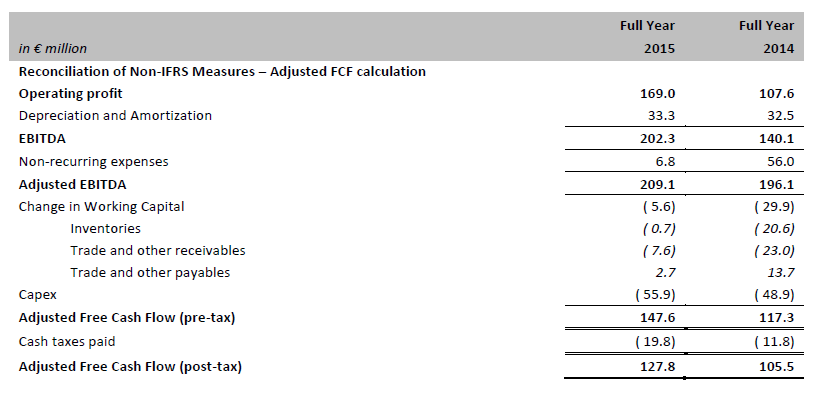

5 Adjusted Free Cash Flow calculated as Adjusted EBITDA less capex, change in working capital and cash taxes paid. Adjusted FCF calculation changed from prior year quarterly disclosure to align with cash flow statement.

Market Dynamics

Growth rates in the markets where Ontex is present were a mixed picture in 2015. There was a deceleration of growth in Western Europe, as price competition intensified in both retail and institutional channels. Developing markets continued to grow, with the rate strongly influenced by higher unit pricing in light of currency weakness, especially in Russia. In these different retail environments, retailer brands continued to gain value share of hygienic disposables in both Western and Eastern Europe.

Foreign exchange rates were volatile during 2015, reflecting increased political and economic uncertainties, and most emerging market currencies weakened versus the euro compared to 2014. The net impact for Ontex was negative, both for revenue and Adjusted EBITDA. This was primarily due to the Russian Rouble, and for Adjusted EBITDA only, the US Dollar, whereas the British Pound had a positive effect on both revenue and Adjusted EBITDA.

In aggregate, costs of our main commodity raw materials in their reference currencies were lower in 2015 compared to the prior year. However costs in euro were higher due to adverse movements in the US Dollar/Euro exchange rate. Fluff pulp costs remained historically high in USD, and even more expensive in euro. In spite of significantly lower pricing of crude oil throughout 2015, costs of our oil-based commodities did not decrease nearly as much and were volatile, with a strong decrease in the second quarter, then sharply increasing in the second half of the year.

Overview of Ontex Performance in 2015

In a more challenging environment than 2014, Ontex continued to make solid progress. Revenue climbed by 4.5% to €1.69 billion, and by 4.8% on a LFL basis. As expected, market growth in most of our key markets was slower in 2015 than the previous year, while competition was higher, particularly in Western Europe. We benefited from our increasing geographic reach, capturing more sales mainly in developing markets.

Adjusted EBITDA was €209.1 million in 2015, despite more than €30 million of FX headwinds, a significant part of which related to the translation of raw material costs into euro. As a result, costs of the major commodity raw materials in euro were higher for the full year due mainly to the strengthening US dollar, despite in aggregate being somewhat lower in their reference currencies. Considerable volatility in the prices for oil-based commodities presented an additional challenge in managing our costs of goods sold. We continued to generate efficiency gains, which together with the contribution from a growing top line, were the main drivers of a 6.6% increase in Adjusted EBITDA.

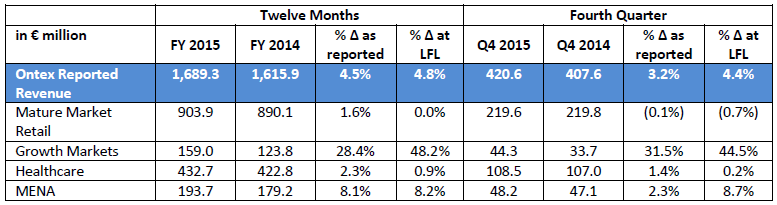

Operational Review: Divisions

Mature Market Retail

Mature Market Retail Divisional revenue for FY 2015 was stable compared to the prior year on a LFL basis (+1.6% on a reported basis, nearly all due to a positive impact of the British pound), and decreased by 0.7% on a LFL basis (-0.1% on a reported basis) in Q4 2015. Both the full year and fourth quarter of 2015 had strong comparable bases. Revenue for FY 2015 was higher in Poland, Southern Europe as well as Australia & New Zealand, compensating for revenue declines mainly in the UK and Germany. In Q4 2015, lower revenue was recorded in the UK and Germany, while Poland, France and Australia & New Zealand had revenue growth.

Intense competition between retailers in some Western European markets, and between suppliers in general, has increased pressure on prices. In this challenging environment, we maintained our retailer brand leadership position with high-quality products and services, as well as innovations, which allowed us to grow revenue at 8 of our 10 largest clients. A disciplined approach to contracts helped to protect our margins, sometimes at the cost of losing some contracts, which will have a negative impact in 2016 due to the net balance of gains and losses. As in past cycles of pricing pressure, our approach can result in revenue declines for a number of quarters, but is the right way to manage for the mid to long term. Our strategy in this Division is unchanged: helping customers to grow their businesses with their brands.

Growth Markets

FY 2015 revenue for the Growth Markets Division climbed 48.2% on a LFL basis (+28.4% on a reported basis due to a negative FX impact, mostly from the Russian Rouble), while Q4 2015 revenue was up 44.5% on a LFL basis (+31.5% on a reported basis). The most important driver of higher Divisional revenue for the full year remained volume growth led by Russia and Central Eastern Europe; and this was also the case in the fourth quarter. In Russia, increasing development of modern retail means these customers are rapidly developing their retail brands from a low level relative to Western Europe. Here we can leverage the strengths of Ontex, by helping these retailers build volume growth of their brands with high-quality products. In addition to higher volumes, revenue was positively impacted by higher average selling prices, mainly realized in Russia, to account for a devaluation of local currencies.

Healthcare

Revenue in the Healthcare Division was up 0.9% on a LFL basis for FY 2015 (+2.3% on a reported basis due to a positive impact of the British Pound), outpacing the estimated growth in the markets where we are present; and 0.2% higher on a LFL basis in Q4 2015 (+1.4% on a reported basis). For the full year, increased revenue in Italy was due to a strong performance in the home delivery channel, additionally the UK and Benelux were also up year on year. Germany and Spain recorded lower revenue.

MENA

Middle East North Africa Divisional revenue grew 8.2% in 2015 on a LFL basis (+8.1% on a reported basis due to a broadly neutral FX impact), and 8.7% higher in Q4 2015 on a LFL basis (+2.3% on a reported basis, mostly due to the Turkish Lira). Ongoing investment behind our brands, such as Canbebe and Canped, led to LFL revenue growth in Turkey, while Pakistan continued to increase sales. Also, we have started to see the first positive signs from actions taken to improve our distribution network in North Africa.

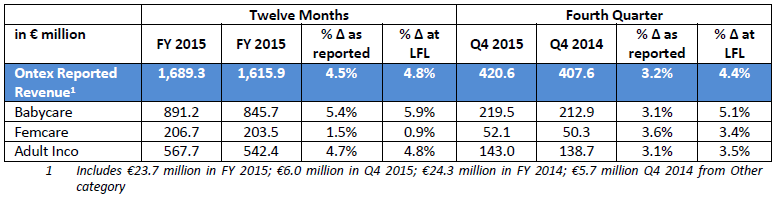

Operational Review: Categories

Babycare

2015 babycare category revenue was up 5.9% on a LFL basis, on top of a high comparable in 2014. Growth was mainly attributable to solid performances in developing markets with our own brands, as well as retailer brands, where we can leverage significant experience in helping retailers to establish and grow their brands.

Femcare

Femcare category revenue in 2015 was +0.9% higher than a year ago on a LFL basis, supported by growth of retailer brands in Eastern Europe. Most of our business in this category continues to be supporting retailers in building their brands in Western Europe.

Adult Inco

Revenue grew by +4.8% on a LFL basis in the Adult Inco category during 2015. Sales were higher in the institutional channel, and at the same time retail sales of adult inco products rose by 14% LFL, with both Ontex brands and retailer brands ahead of last year.

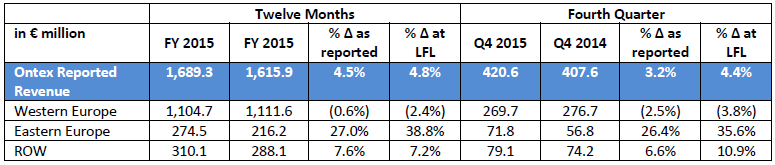

Operational Review: Geographies

Revenue in Western Europe decreased in a challenging market environment, while Eastern Europe and the Rest of the World had solid growth and combined to represent 35% of total Ontex revenue in 2015, up from 31% last year.

OUTLOOK

The macro environment remains very challenging, with strong pressures due to political and economic uncertainties, and continuing fierce price competition in European retail. 2016 market growth rates are expected to be slightly lower than 2015 including some price deflation in Western Europe, with the impact of movements in developing market currencies and related pricing being difficult to forecast. Given sustained lower costs of crude oil, prices for the oil-based commodities we purchase should ease in the coming months. Fluff pulp pricing remains at very near historically high levels in USD.

The acquisition of Grupo Mabe will make a significant positive contribution in absolute terms to Ontex’s results, including revenue and Adjusted EBITDA. For revenue, our mid-term model is to target annual growth of between 4% and 6% on a like-for-like basis. In 2016, we expect that delivering at the bottom-end of this range will still be challenging, due to tougher macro and market conditions, the net balance of gains and losses in Mature Market Retail which will be particularly acute in the first half, and anticipated price deflation in Western Europe. We are confident that our pipeline of actions in MMR will lead to a resumption of revenue growth, and expect solid LFL growth in our MENA and Growth Market Divisions with continued progress in Healthcare. Therefore, on a LFL basis, we anticipate Group revenue to have a very slow start to 2016, with a pick up over the second half to deliver a stronger finish to the year.

Adjusted EBITDA in absolute terms will also increase mainly thanks to ongoing top line and efficiency gains in Ontex, a contribution from Grupo Mabe and starting to deliver deal synergies. With the EBITDA margin of Grupo Mabe before synergies being lower than Ontex, the Adjusted EBITDA margin in 2016 is anticipated to be broadly similar to 2015, as a percentage of significantly higher revenue.

Our strategy of supplying high-quality products and services to retail and institutional customers remains unchanged. We will continue to invest in understanding consumers and shoppers even better, in order to be the supplier of choice for our customers, whether it is with their brands or Ontex brands.

We are motivated to make significant progress on our journey of becoming a leading consumer goods company, and thanks to our resilient business model, are confident that we can continue delivering sustainable, profitable growth.

FINANCIAL REVIEW

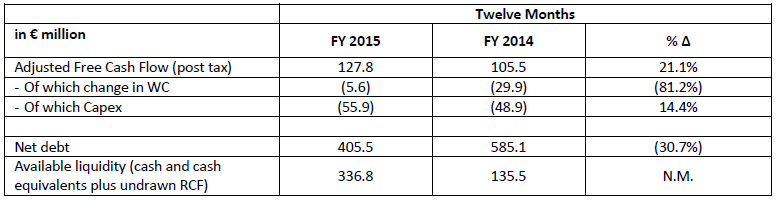

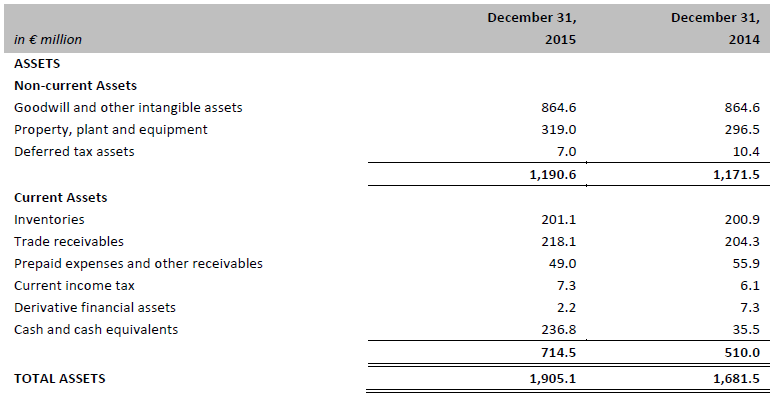

Selected P&L Financial Information

Selected Liquidity Financial Information

Gross Margin

Gross margin in 2015 of €475.6 million was 6.5% higher than last year. Gross margin as a percentage of sales rose from 27.6% in 2014 to 28.2% in 2015, an increase of 51 basis points. The main positive drivers of this growth were the impact of top line growth and solid efficiency gains, which enabled us to more than offset significant currency headwinds.

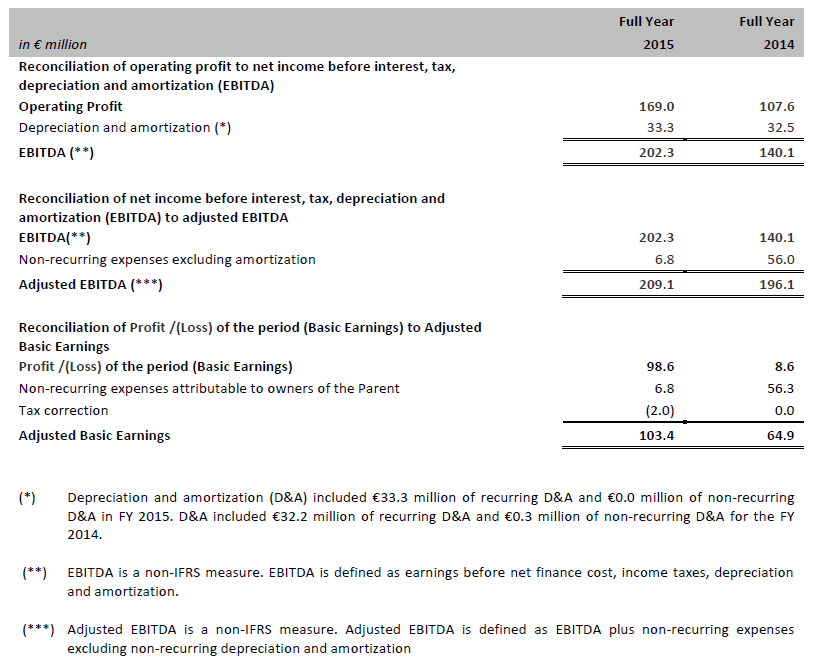

Adjusted EBITDA

Adjusted EBITDA is a non-IFRS measure is defined as EBITDA plus non-recurring expenses (including the IPO and refinancing for 2014) and revenues excluding non-recurring depreciation and amortization. EBITDA is also a non-IFRS measure, defined as earnings before net finance cost, income taxes, depreciation and amortization.

Adjusted EBITDA grew by 6.6% to €209.1 million. The increase is mainly the result of improved gross margins as explained above, and despite the background of volatile FX and tough competition, the company continued to strengthen its capabilities in sales, marketing and administrative support.

Foreign Exchange

Group revenue was negatively impacted by heightened currency volatility in 2015: after a positive effect in the first half of the year, currency movements turned into headwinds in the second half. The full year impact of -€4.6 million on revenue is primarily due to changes in exchange rates versus the euro for the Russian Rouble, while the Turkish Lira was also negative for the full year after weakening in the second half of 2015. The British Pound had a positive impact for the full year.

The FX impact on Adjusted EBITDA was negative €30.6 million, and worsened considerably in the second half of 2015. In addition to negative changes in exchange rates for the Russian Rouble and Turkish Lira, partly offset by the favorable evolution of the British Pound mentioned above, the main negative FX impact on Adjusted EBITDA came from a stronger US Dollar versus the euro.

Net Finance Costs

The 2015 net finance costs were €36.2 million, 59.9% lower than 2014. The strong decrease was mainly due to a significant reduction in interest expenses, as well as to much lower amortization of borrowing costs compared to 2014. These impacts are in line with our expectations, and resulted from both lower net debt following redemption of a floating rate note after the company’s IPO, and refinancing of the remaining debt at lower interest rates in 2014.

Income Tax Expense

The income tax expense was €34.2 million in 2015, resulting in an effective tax rate of 25.8%.

Since the IPO of Ontex, the company has anticipated an effective tax rate in the mid-20s from fiscal year 2015 onwards, based on the same scope of activity and same tax regime. Due to the acquisition of Grupo Mabe, and a recent decision by the European Commission that the Belgian excess profit ruling is considered illegal state aid, we anticipate that our future effective tax rate should be in the high 20s.

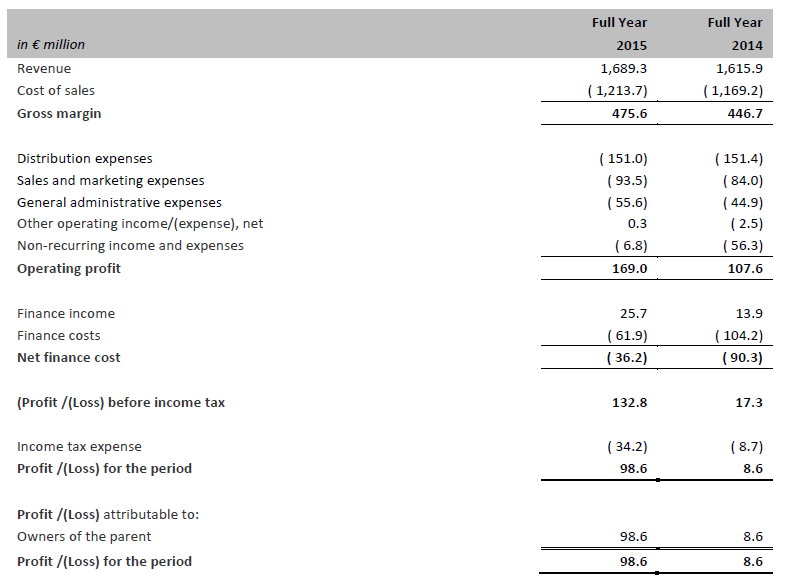

Working Capital

Working capital was at 10.5% of revenue in 2015, within our objective of keeping working capital requirements at or below 12% of revenue. Compared to the previous year, in which working capital was 11.4% of revenue, the main driver was a decrease in VAT receivables following the sale of an Italian VAT receivable in mid 2015. Aside from this, working capital management continued to be a focus of the Company to support business growth while maintaining financial discipline.

Capex

2015 capital expenditures amounted to €55.9 million, which at 3.3% of sales is slightly higher than our long term model of 3% of sales. The increase is mainly linked to investments in our IT systems, as disclosed in our H1 2015 results.

Adjusted Free Cash Flow (post tax)

Adjusted Free Cash Flow calculated as Adjusted EBITDA (see definition above) less capex, change in working capital and cash taxes paid.

Adjusted free cash flow (post tax) was €127.8 million in 2015, which represented an increase of 21.1% compared to 2014. This increase is attributable to improved working capital detailed above and higher Adjusted EBITDA, partly offset by higher capex and cash taxes paid.

Financing and Liquidity

Cash and cash equivalents were €236.8 million at December 31, 2015.

Net debt at December 31, 2015 amounted to €405.5 million, and net leverage based on the last twelve months Adjusted EBITDA was 1.94x.

The revolving credit facility of €100 million was undrawn at the end of December 2015, and available liquidity was €336.8 million.

Cash and cash equivalents, net debt and leverage, and available liquidity were all positively impacted by the Company holding cash raised in November 2015, in anticipation of completing the acquisition of Grupo P.I. Mabe S.A. de C.V, which took place on February 29 2016.

Dividends

The Board of Directors has proposed a dividend of €0.46 per share, representing a payout ratio of 35% and consistent with the company’s dividend policy. The dividend is subject to shareholder approval at the next Annual General Meeting of Shareholders.

Notes to the Consolidated Financial Information Note 1 Corporate Information

Note 1 Corporate information

The above press release and related financial information of Ontex Group NV for the twelve months ended December 31, 2015 was authorized for issue in accordance with a resolution of the Board on March 7, 2016.

Note 2 Legal Status

Ontex Group NV is a limited-liability company incorporated as a “naamloze vennootschap“ (“NV”) under Belgian law. Ontex Group NV has its registered office at Korte Keppestraat 21, 9320 Erembodegem (Aalst), Belgium. The shares of Ontex Group NV are listed on the regulated market of Euronext Brussels.

Note 3 Accounting Policies

The accounting policies used to prepare the financial statements for the period from January 1, 2015 to December 31, 2015 are consistent with those applied in the audited consolidated financial statement for the year ended December 31, 2014 of Ontex Group NV. The accounting policies have been consistently applied to all the periods presented.

Note 4 Events after the Reporting Period

On February 29 2016, Ontex has completed the acquisition of 100% of the shares of Grupo P.I. Mabe, S.A. de C.V. (“Grupo Mabe”) a leading Mexican hygienic disposables business. The integration of Grupo Mabe will provide Ontex Group further access to promising markets, primarily in the Americas region and creates a considerably stronger platform for growth in the global personal hygiene solutions markets.

Note 5 Auditors Report

The statutory auditor has confirmed that the audit, which is substantially complete, has not to date revealed any material misstatement in the draft consolidated accounts, and that the accounting data reported in the press release is consistent, in all material respects, with the draft accounts from which it has been derived.

CONFERENCE CALL

Management will host a presentation for investors and analysts on Tuesday March 8, 2016 at 8:00am GMT / 9:00am CET. A copy of the presentation slides will be available at http://www.ontexglobal.com/.

If you would like to participate in the conference call, please dial-in 5 to 10 minutes prior using the details below:

United Kingdom: +44 (0)2 03 42 71918

United States: +1 212 444 0896

Belgium: +32 (0)2 40 23 092

France +33 (0)1 76 77 22 22

Germany +49 (0)69 2222 10630

Passcode: 4743790

FINANCIAL CALENDAR 2016

First Quarter 2016 May 4, 2016

Annual General Meeting May 25, 2016

Second Quarter and Half Year 2016 July 28, 2016

Third Quarter and Nine Months 2016 November 9, 2016

Contact

ANNEX A ONTEX GROUP NV CONSOLIDATED FINANCIAL INFORMATION

Consolidated Income Statement

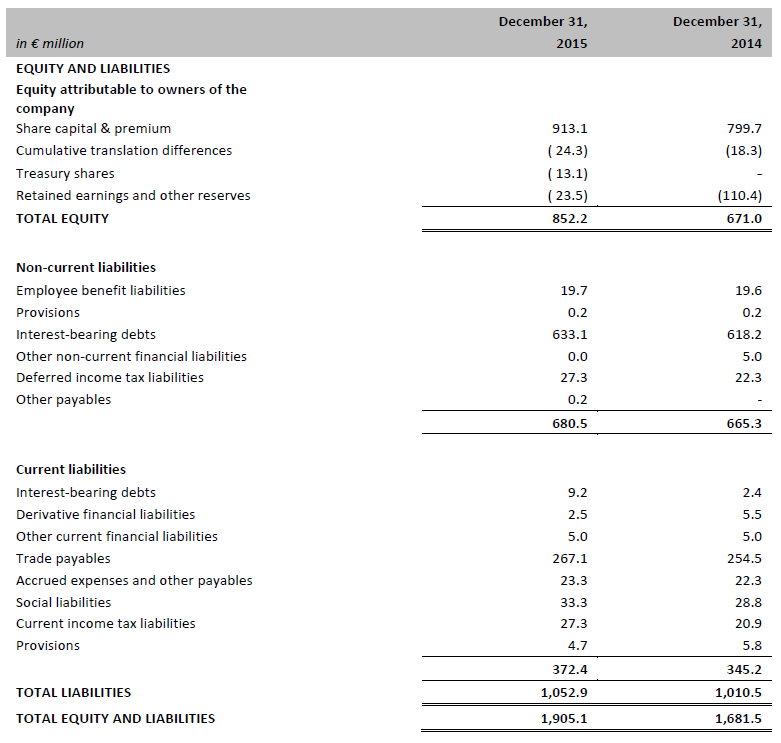

Consolidated Statement of Financial Position

Consolidated Statement of Financial Position (continued)

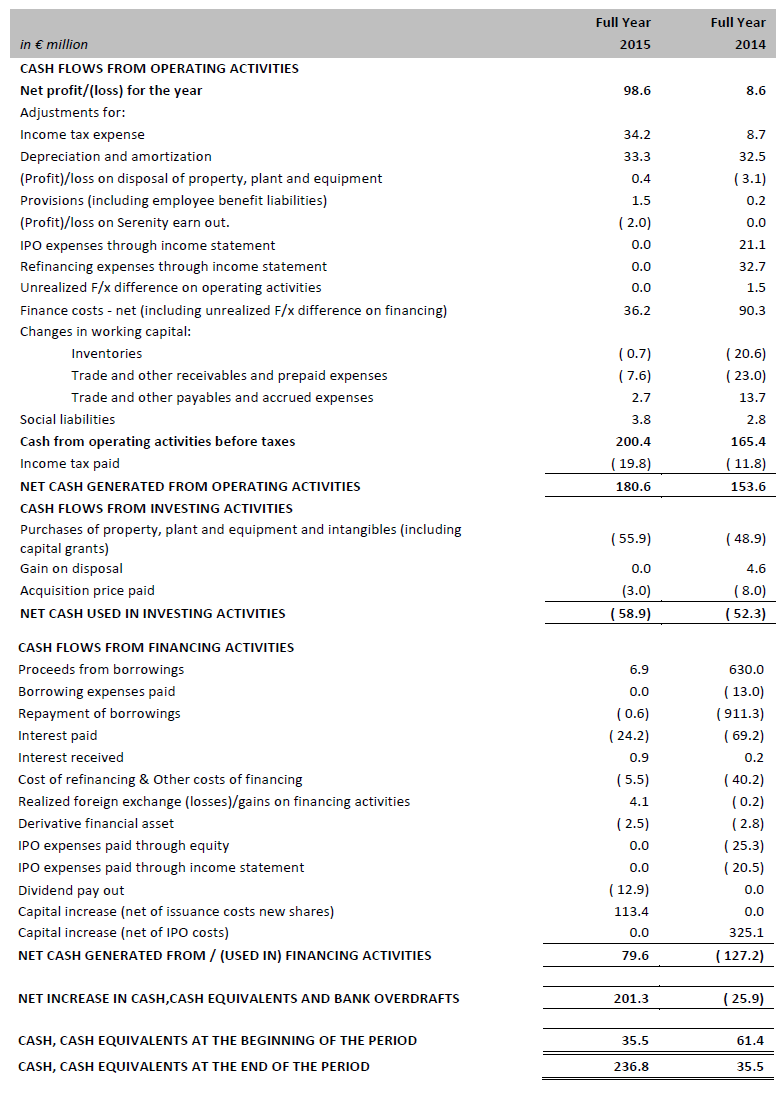

Consolidated Statement of Cash Flow

Additional Financial Information

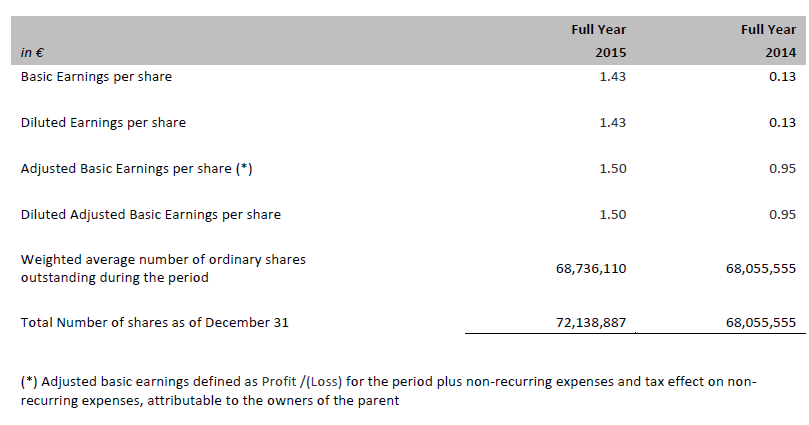

EARNINGS PER SHARE

Additional Financial Information

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES

Additional Financial Information

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES

DISCLAIMER

This report may include forward-looking statements. Forward-looking statements are statements regarding or based upon our management’s current intentions, beliefs or expectations relating to, among other things, Ontex’s future results of operations, financial condition, liquidity, prospects, growth, strategies or developments in the industry in which we operate. By their nature, forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results or future events to differ materially from those expressed or implied thereby. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein.

Forward-looking statements contained in this report regarding trends or current activities should not be taken as a report that such trends or activities will continue in the future. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You should not place undue reliance on any such forward-looking statements, which speak only as of the date of this report.

The information contained in this report is subject to change without notice. No re-report or warranty, express or implied, is made as to the fairness, accuracy, reasonableness or completeness of the information contained herein and no reliance should be placed on it.

In most of the tables of this report, amounts are shown in € million for reasons of transparency. This may give rise to rounding differences in the tables presented in the report.

This report has been prepared in Dutch and translated into English. In the case of discrepancies between the two versions, the Dutch version will prevail.